Share in our growth as we meet the demand for golf entertainment. Whether it’s an urban bar or an outdoor range, we can tailor our golf entertainment venues to 200+ potential markets.

At GolfSuites, we believe in creating long-term value for our investors. While we have no concrete exit plans as we’re currently focused on expanding our business, there are several potential ways your investment could generate returns in the future.

Golf hasn’t seen a phenomenon like this since Tiger Woods. For the first time in history, golf participation exceeded 40M people. That’s thanks to the explosive, barrier-breaking popularity of golf entertainment venues – an industry projected to reach $37.5B1 by 2026.

At GolfSuites, we believe in creating long-term value for our investors. While we have no concrete exit plans as we’re currently focused on expanding our business, there are several potential ways your investment could generate returns in the future.

This versatility allows us to operate virtually anywhere, further enhanced by our leaderboard-worthy experience:

Topgolf doesn’t work everywhere. But thanks to our adaptable venue types, GolfSuites does. By targeting cities with populations of 75,000 or more, we focus where others can’t. Our facilities cost less to build, feature best-in-class tracking technology and golf equipment, and source local ingredients for affordable farm-to-table food and drink – all at a lower cost than our competitors.

We have a proven track record of opening profitable golf entertainment venues. Every location we’ve opened has been profitable. That’s because we have excellent product-market fit. We’ve already turned two failed sites of competitors into profitable venues.

There are 444 cities in the U.S. with 75,000+ people, showing our extensive expansion potential. In mid-2024, we’ll officially open our first GolfSuites City Club in St. Petersburg, Fla. But that’s not all…

A new Topgolf range costs up to $72 million – and that’s excluding the price of the 65,000+ square feet of land. GolfSuites cost no more than $15 million to build. Our model can be retrofitted to preexisting driving ranges, used for new construction, or applied to indoor venues. Our 40% margin potential means 40-bay venues can generate up to $4M in annual revenue.

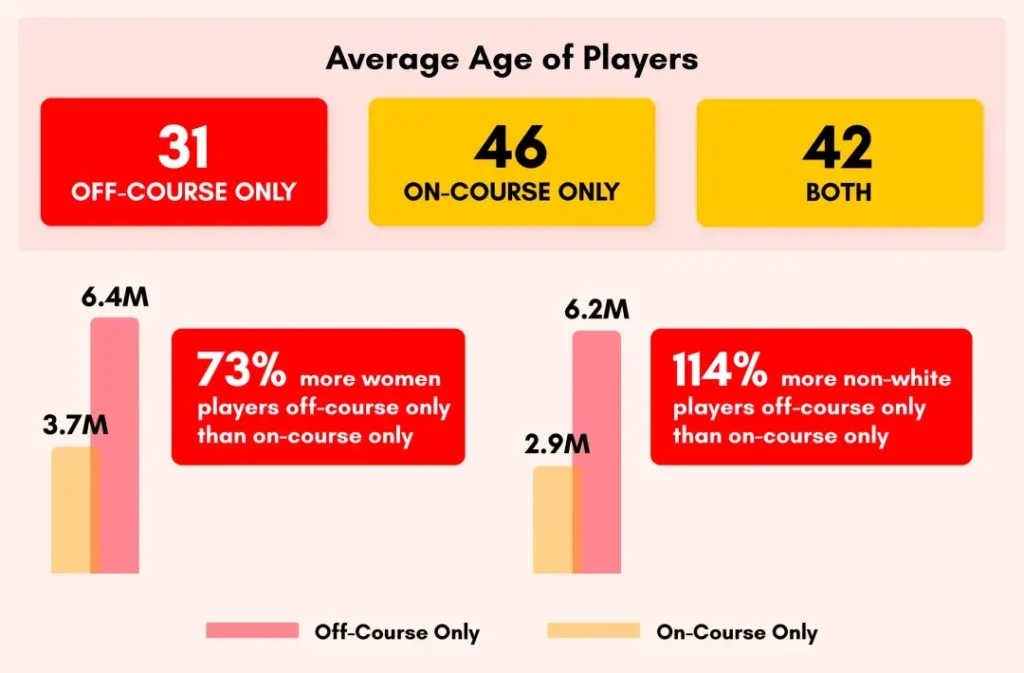

While on-course growth is just 8% since 2017, off-course has skyrocketed 55%. A 2022 study showed 21m U.S. non-golfers are “very interested” in picking up the sport. The untapped market is still sizable if barriers – namely accessibility – are removed. Golf entertainment venues are doing just that, introducing new customers.

Golf leaders are pouring money into golf entertainment. GolfSuites is one of the only opportunities open to everyday investors. Join Shark Tank’s Kevin Harrington by investing in GolfSuites.

45+ years of experience in real estate finance, ownership, and management

25 years of experience in real estate development, general contracting

This is a accredited investor only opportunity for $25,000 minimum into equity participation in our sites.

Minimum is $25,000

GolfSuites stands out by combining entertainment with golf, creating a destination where golfers can enhance their skills, enjoy a fun atmosphere, and engage in the future of golf. Traditional facilities typically offer just a golfing experience.

Our locations are already profitable, the market is big and growing (people both want to golf and want to go to entertainment venues like these, TopGolf is proving the demand too), and we have clear differentiators over our competitors with plenty of market share up for the taking.

This is an excellent early-stage opportunity to invest in a proven business model v. buying a potentially overpriced public stock in a company that has a lot of different interests than just TopGolf.

Our company is already generating profits from multiple sources. We have a successful strategy in place to maximize our revenue, which includes income from both food and beverage services and golf-related activities. These revenue streams are well-established and contribute significantly to our financial success.

The funds raised from this funding round will be instrumental in supporting our expansion efforts. We plan to use the proceeds to expand our presence into new areas and additional sites. This expansion will allow us to reach a broader audience and grow our business in strategic locations.

No, costs are the same, regardless of how you invest or how much you invest.

The PPM and deck contain the full data on this. To summarize, this is equity participation which carries a 9% pref and anticipated 17.4% annual yield.

The plan is to build a successful, valuable company. Exit opportunities like an acquisition or IPO could follow in due course.

An accredited investor has an income of $200k, or $300k if filing jointly. Or $1M in liquid net worth. For full information, please see the "investor education" link at the top of this page.

Read the "investor education" link at the top of the page. You can also set up an appointment with one of our consultants by clicking the link at the top of this page to find out directly what options may be available to you.

Sources:

1 – https://www.technavio.com/report/family-entertainment-center-market-industry-analysis

This website contains forward-looking statements. These statements may include the words “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “project”, “will”, “may”, “targeting” and similar expressions as well as statements other than statements of historical facts including, without limitation, those regarding the financial position, business strategy, plans, targets and objectives of the management of GolfSuites 1, Inc. (the “Company”) for future operations (including development plans and objectives). Such forward-looking statements involve known and unknown risks, uncertainties and other important factors which may affect the Company’s ability to implement and achieve the economic and monetary policies, budgetary plans, fiscal guidelines and other development benchmarks set out in such forward-looking statements and which may cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company’s present and future policies and plans and the environment in which the Company will operate in the future. Furthermore, certain forward-looking statements are based on assumptions or future events which may not prove to be accurate, and no reliance whatsoever should be placed on any forward-looking statements in this presentation. The forward-looking statements in this website speak only as of the date of the Company’s initial Offering Statement, and the Company expressly disclaims to the fullest extent permitted by law any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained herein to reflect any change in expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based.